venmo tax reporting for personal use

Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes. We offer accounts for two types of purposes.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Tax Reporting for Payments of 600 or More.

. Use the Right Tax Form. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. A business cant use a personal account because it doesnt provide the necessary tax records.

Personal accounts and approved business accounts. The tax code allows you to deduct certain costs of doing business from gross income. The change took effect Jan.

The tax reporting requirement started on 2012 though the threshold then was higher. To create a personal account. You will pay taxes on any portion of funds considered taxable income.

This income will be reported. In 2022 Venmo PayPal and Cash App are required to. For most states the threshold.

Rather small business owners independent. Though proposed in 2021 this will. A business cant use a personal account because it doesnt provide the necessary tax records.

This new regulation a. For example a taxpayer who uses their car for business may qualify to claim the. If youve previously accepted payments and have.

The IRS views the payment andor receipt of money through Venmo or any similar peer-to-peer P2P app the same as a traditional payment andor receipt of cash. Its simply a change in tax reporting for these third-party companies. Previous post With a small footprint of just 4.

But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. The best way to avoid having personal. Tax Reporting for Payments of 600 or More.

If youre among the millions of people who use payment apps like PayPal Venmo Square and other third-party electronic payment networks you could be affected by a. If you use PayPal Venmo or other P2P platforms. If you do at least 600 in business on the.

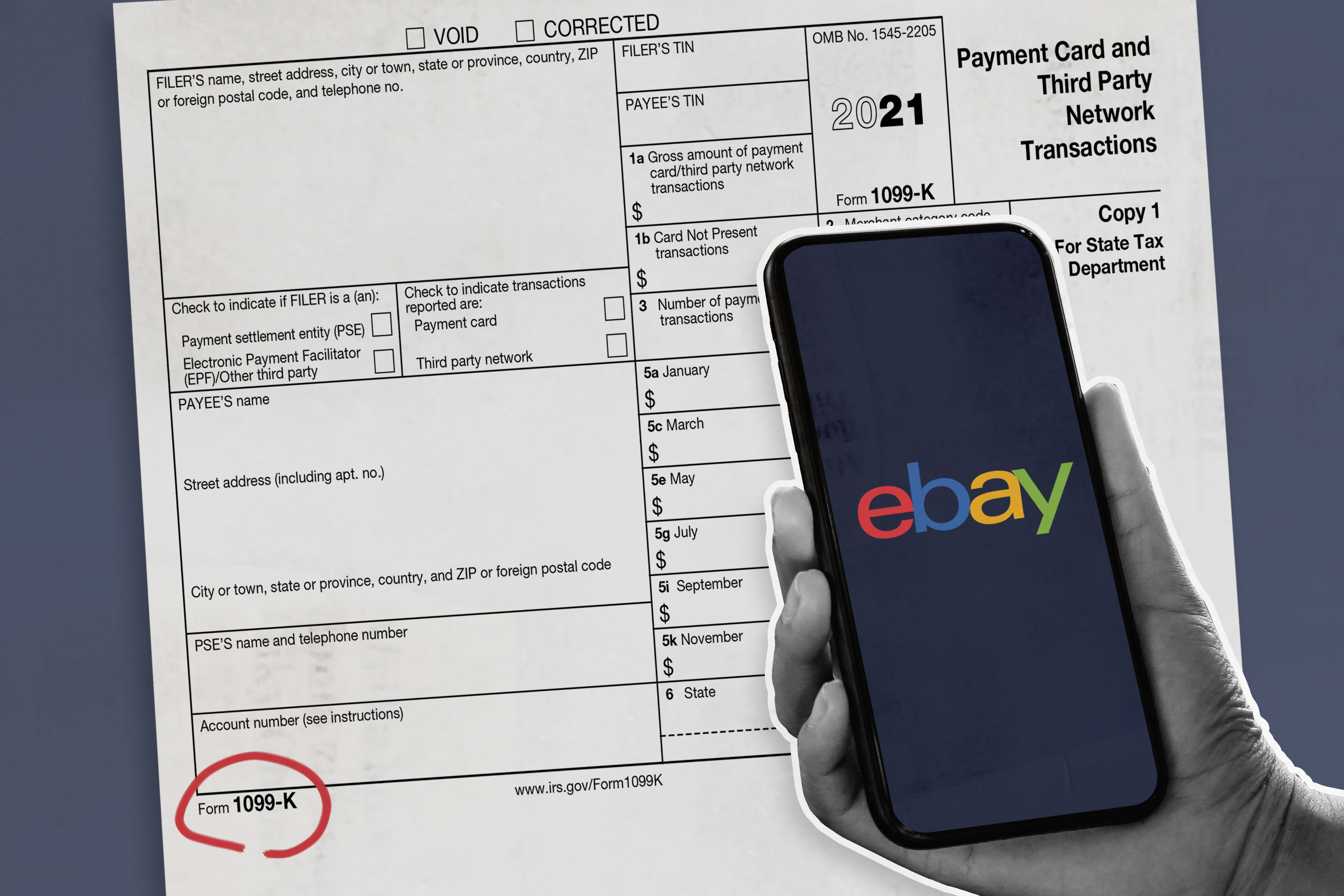

Venmo tax reporting for personal use 2022 Friday February 18 2022 Edit. Before 2022 the minimum threshold for reporting business transactions in a tax year was 20000 in gross payments and more than 200 transactions. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

1 2022 so filers dont need to worry about it this tax filing season. If this number was met the. Businesses using Venmo to pay employees should be sure to issue them a 1099-MISC form especially if you pay them more than 600 a year.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting. You may only have one personal account.

Anyone who receives at least. 1099-NEC Used to report on the 1099-MISC Remember that the Internal Revenue Service still requires you to report your income for goods or services even if you didnt receive 20000. Rather small business owners independent contractors.

To be clear this new regulation does not add a new tax. The best way to avoid having personal transactions reported to the IRS is to use separate. For those who use Venmo Paypal and CashApp payment for goods and services must be reported to the IRS if the transactions exceed 600.

The changes arent limited to popular big-brand payment apps.

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Paypal Venmo Cash App Sellers Must Report Revenue Over 600 Wtsp Com

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

The Irs Is Not Taxing Venmo Zelle Cash App Transactions Khou Com

Network Payment Reporting Threshold Of 600 Goes Into Effect Frazier Deeter Llc

Fact Or Fiction Could You Soon Owe Taxes On Venmo Transactions Youtube

New Law Impacting Peer To Peer Payment App Users

You Made 700 From An Online Side Hustle Now The Irs Will Know Wsj

Irs To Track Business Payments Through Paypal Venmo Zelle

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

How Using Paypal And Venmo Affects Your Taxes As A Freelancer

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post